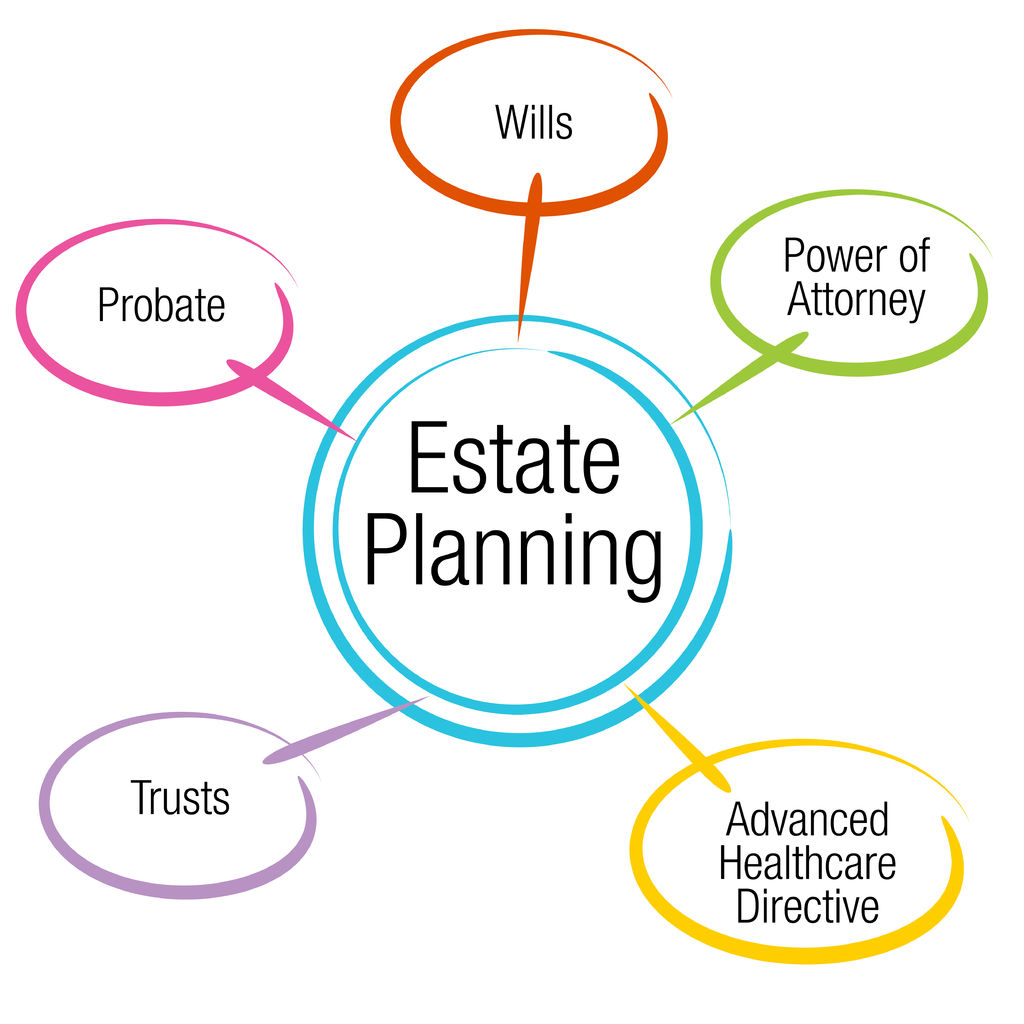

Creating a Trust for Oklahoma Estate Planning affords you more flexibility in your estate planning options. Creating a trust is often an essential part of your estate planning process. Estate planning Attorneys use varying types of trusts depending on your specific needs and wants. This allows you to have control over the assets, may protect you from tax liability, and protects parts of your estate from probate. This article discusses the different trusts and the advantages in creating a trust.

Creating a Trust for Oklahoma Estate Planning

- Revocable Trusts

Probably the most common trust instrument is a revocable trust plan. This is the most flexible of any trust. You can amend, change, or end this trust whenever you wish. Thus, it is advantageous in that you can use the trust assets to handle any unexpected circumstances that might arise.

whenever you wish. Thus, it is advantageous in that you can use the trust assets to handle any unexpected circumstances that might arise.

-

Irrevocable Trusts

Revocable trusts become irrevocable upon death. This is the main way trusts are designated as irrevocable. This is because irrevocable trusts during a lifetime are extremely rare. You cannot terminate, amend, or change the terms of the trust once it is put into place. It locks all the assets you place in it essentially forever. The advantage of creating a trust that is irrevocable is that it entirely separates the assets from your estate. As a result, you no longer face any tax liability on the assets.

- Testamentary Trusts

Testamentary trusts are exactly what they sound like—a trust that becomes effective upon your death. Many people will create a testamentary trust in order to provide inheritance to minors, such as grandchildren. You are able to provide certain rules that the trust must operate by. These are a cheap way of making sure the money is not squandered and your heirs can truly get the benefits.

Read About Step Parent Adoption and Estate Planning

-

Intervivos Trusts

Intervivos trusts are generally revocable trusts for when you are still living. These have several advantages including the fact that you can be the trustee administering the assets. The catch though, is that the trust must have a definite purpose and you must administer it on terms aligning with that purpose.

Creating an Oklahoma Trust for You

Creating a Trust For Oklahoma Estate Planning is a personal to each trustor. The process of creating a trust is not always complex but depends on your particular situation. To begin you fill out a trust document that set out certain rules of the Trust. You can find prefabricated forms or create one of your own if yours is a simple Trust. However, you must make sure the forms have the name of the trustee, a specific beneficiary, and a signature with notary proof and depending on the Trust other requirements. Once you complete these steps, you essentially have a very basic trust in your estate plan which work together as whole plan. At this point you may begin transferring assets to the trust. Its important that you transfer property to the trust otherwise known as funding the Trust. If you dont this could have adverse impacts on your goals for creating the Oklahoma Trust

Our OKC Estate Attorneys can help you fill out the proper documents to create your trust. We have years of experience writing wills and last testaments for clients who have intricate estate plans. Let us make sure your plan is as seamless as possible.